Touching the online business world, ecommerce credit cards have become indispensable tools that facilitate seamless transactions and provide vital financial flexibility. For inventory-driven enterprises, these cards are instrumental in managing cash flow and scaling operations efficiently.

Consider the experience of an Amazon seller who shared:

“In the past year, I spent over $2 million on my credit card for inventory. This resulted in over $4 million in revenue, technically without even spending my own money.”

This example underscores the transformative potential of strategic credit card use in ecommerce.

Understanding eCommerce Credit Card Processing

Efficient ecommerce credit card processing is the backbone of successful online operations. Here’s an overview:

- How it works: When a customer makes a purchase, their card information is securely transmitted through the ecommerce credit card payment system. The payment gateway communicates with the acquiring bank and card network to authorize the transaction.

- Key components:

- Payment gateway – Facilitates transaction requests.

- Merchant account – Temporarily holds payments before funds are transferred.

- Payment processor – Manages communication between the card network and banks.

- Fraud detection systems – Ensure secure transactions.

- Benefits of streamlined processing:

- Faster checkout experiences.

- Reduced cart abandonment rates.

- Improved cash flow management.

Top Credit Cards for eCommerce Businesses in 2024

Selecting the right credit card is crucial for maximizing benefits. Here are some top picks:

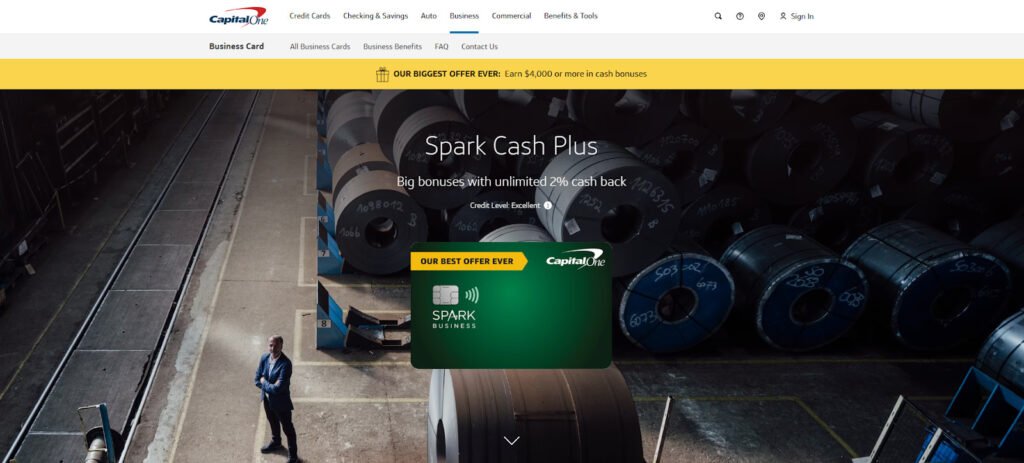

1. Capital One Spark Cash Plus Card

Image Source: capitalone.com

Features:

- 2% cash back on all purchases.

- 5% cash back on hotels and rental cars booked through Capital One Travel.

- $1,000 cash bonus ($500 after spending $5,000 in the first three months, and an additional $500 after spending $50,000 in the first six months).

Pros:

- Simplicity in earning cash back.

- No preset spending limit.

Cons:

- $150 annual fee.

- Requires a personal guarantee.

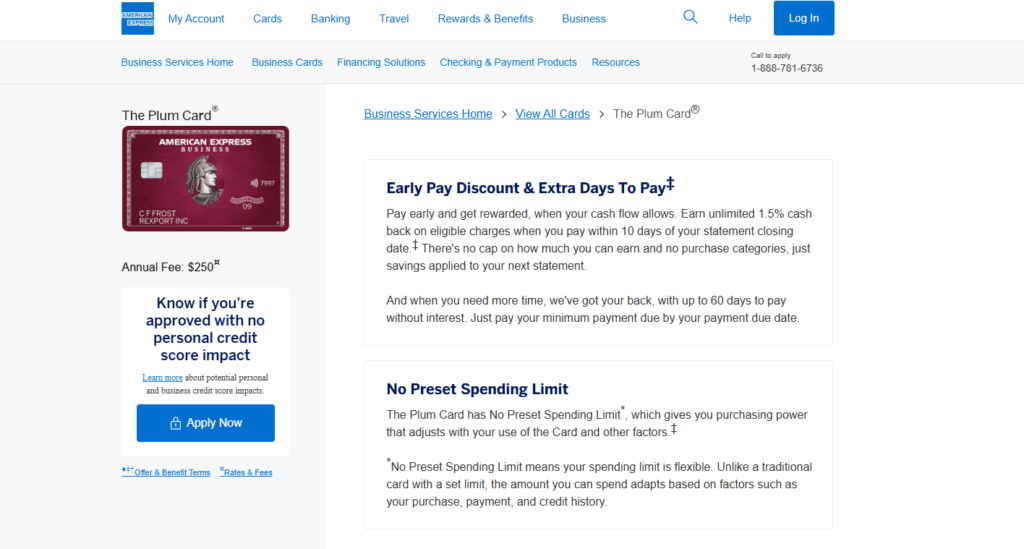

2. American Express Plum Card

Image Source: americanexpress.com

Features:

- 60-day payment terms.

- 1.5% back for early payments.

- No preset spending limit.

Pros:

- Flexible payment options.

- Rewards for early payments.

Cons:

- Annual fee applies.

- Requires good credit for approval.

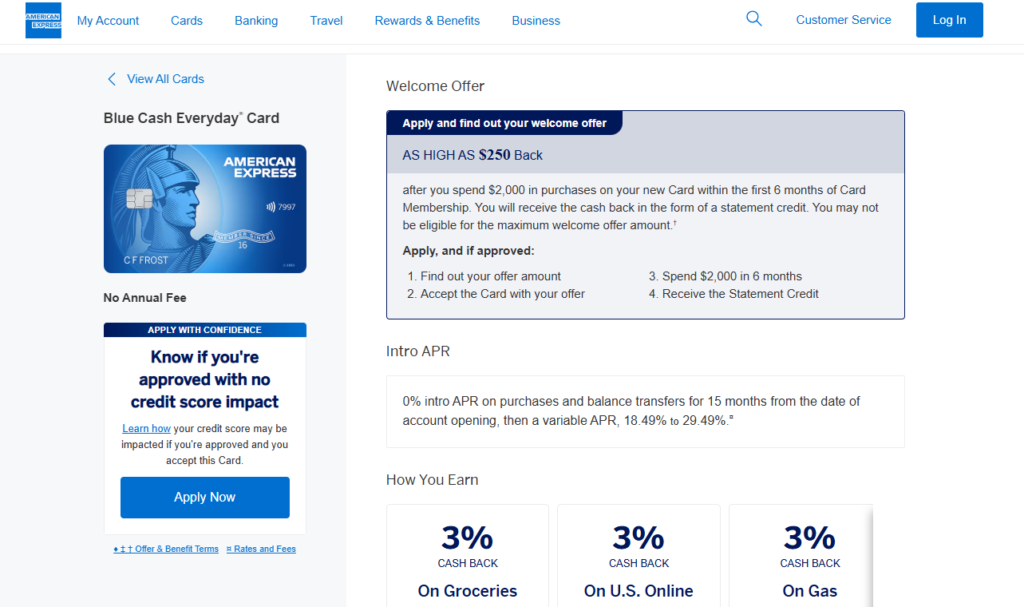

3. American Express Blue Cash Everyday Credit Card

Image Source: americanexpress.com

Features:

- 0% APR for the first 15 months.

- Cash back on everyday categories.

- No annual fee.

Pros:

- Interest-free period for 15 months.

- No annual fee.

Cons:

- Cash back categories may have limits.

- Requires good credit for approval.

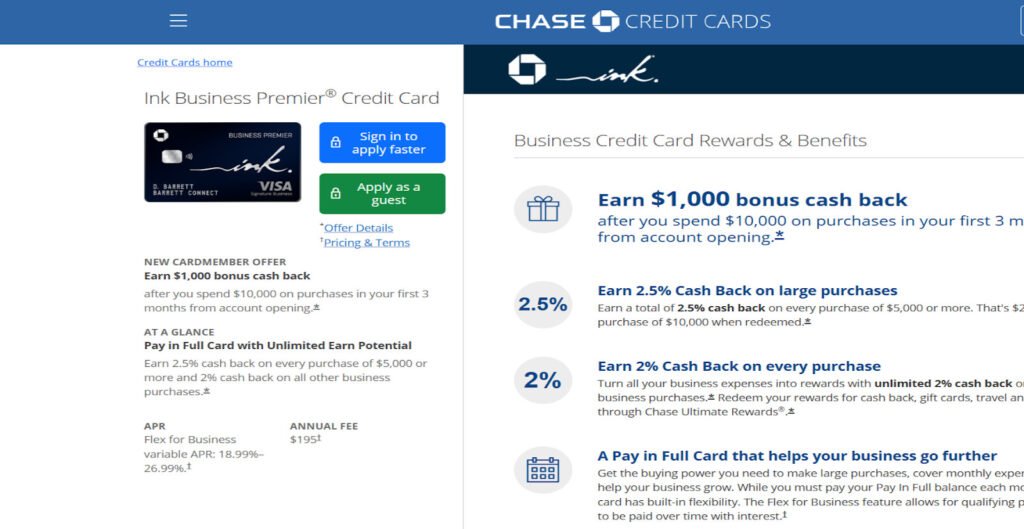

4. Chase Business Premier Card

Image Source: creditcards.chase.com

Features:

- 2% cash back on all purchases.

- 2.5% cash back on transactions over $5,000.

Pros:

- Higher cash back on large purchases.

- No foreign transaction fees.

Cons:

- Annual fee applies.

- Requires excellent credit for approval.

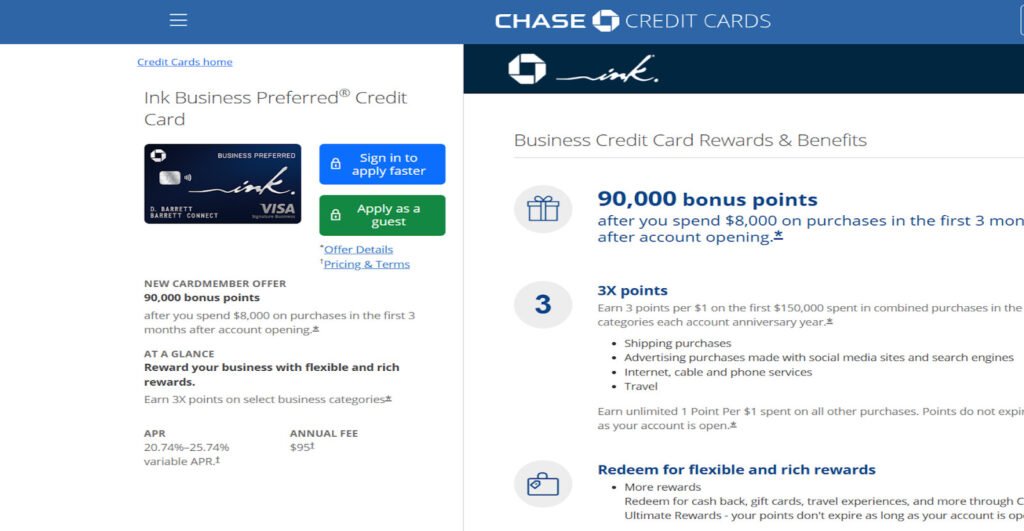

5. Chase Business Preferred Card

Image Source: creditcards.chase.com

Features:

- 3x points on advertising and shipping expenses (up to $150,000 annually).

- Points transferable to travel partners.

- Cell phone protection when paying your bill with the card.

Pros:

- High rewards on business-related expenses.

- Comprehensive travel benefits.

Cons:

- Annual fee applies.

- Requires excellent credit for approval.

Maximizing Credit Card Benefits for eCommerce

To fully leverage your credit card:

- Align purchases with statement cycles to maximize float time.

- Use different cards for specific expense categories to optimize rewards.

- Reinvest cash back rewards into business growth initiatives.

Credit Card Processing for eCommerce Platforms

Integrating credit card processing for e-commerce platforms is essential. Consider:

- Compatibility with major platforms like Shopify, WooCommerce, and Magento.

- PCI DSS compliance for secure transactions.

- Mobile payment options to cater to smartphone shoppers.

Choosing the Best Business Credit Card

When selecting the best business credit card for 2024, evaluate:

- Annual fees versus potential rewards.

- Interest rates and introductory offers.

- Credit score requirements and your business’s creditworthiness.

Advanced eCommerce Credit Card Strategies

Enhance your strategy by:

- Utilizing 0% APR offers for large inventory purchases.

- Negotiating lower processing rates as your volume increases.

- Strategically timing credit limit increase requests.

Future Trends in eCommerce Credit Card Processing

Stay ahead by preparing for:

- Increased adoption of contactless and biometric payment methods.

- AI-driven fraud detection and prevention.

- Integration of blockchain technology for enhanced security.

Case Studies: eCommerce Businesses and Their Strategies

Learn from real-world examples:

- Small Business Success: A niche retailer used rotating category cards to maximize rewards.

- Mid-Size Growth: Leveraged balance transfer offers to finance expansion.

- Large-Scale Operations: Customized corporate card programs for multi-million-dollar ecommerce brands.

Conclusion: eCommerce and Smart Credit Card Use

The right ecommerce credit card processing strategy can transform your online business, enabling it to scale efficiently and operate with greater financial flexibility. By selecting the best business credit card for 2024 that aligns with your spending patterns, leveraging introductory offers, and maximizing rewards, you can significantly enhance your bottom line.

As highlighted earlier, a strategic approach to credit card processing e-commerce can empower businesses to grow exponentially without relying on personal finances.

Take action today to optimize your operations:

- Review your current ecommerce credit card payment system to ensure it aligns with your business goals.

- Explore the top credit card options listed above and choose one that suits your spending habits and expansion plans.

- Incorporate advanced strategies such as timing purchases with statement cycles, negotiating better processing rates, and maximizing cash back or travel rewards.

Additionally, consider integrating robust credit card processing ecommerce solutions into your platform to offer your customers a seamless shopping experience.

Enhance Your Product Listings with Visual Excellence

While improving your financial strategies, don’t forget to enhance your product presentations. Visual appeal plays a crucial role in online sales. Explore these resources for optimizing your product images:

- How to Edit Product Photos to refine your product listings.

- Proper Product Photo Lighting to ensure visually appealing images.

- How to Remove Backgrounds from Images for a clean, professional look.

- Changing Background Colors to maintain brand consistency.

Sign Up for ProductScope AI Today!

By combining these visual strategies with smart financial tools like ecommerce credit card payment systems, you’ll set your ecommerce business apart from the competition, ensuring sustainable growth and success in 2024 and beyond.